CTV Ascends: Navigating the Future of Digital Advertising with Transparency

CTV Advantage Today and Tomorrow

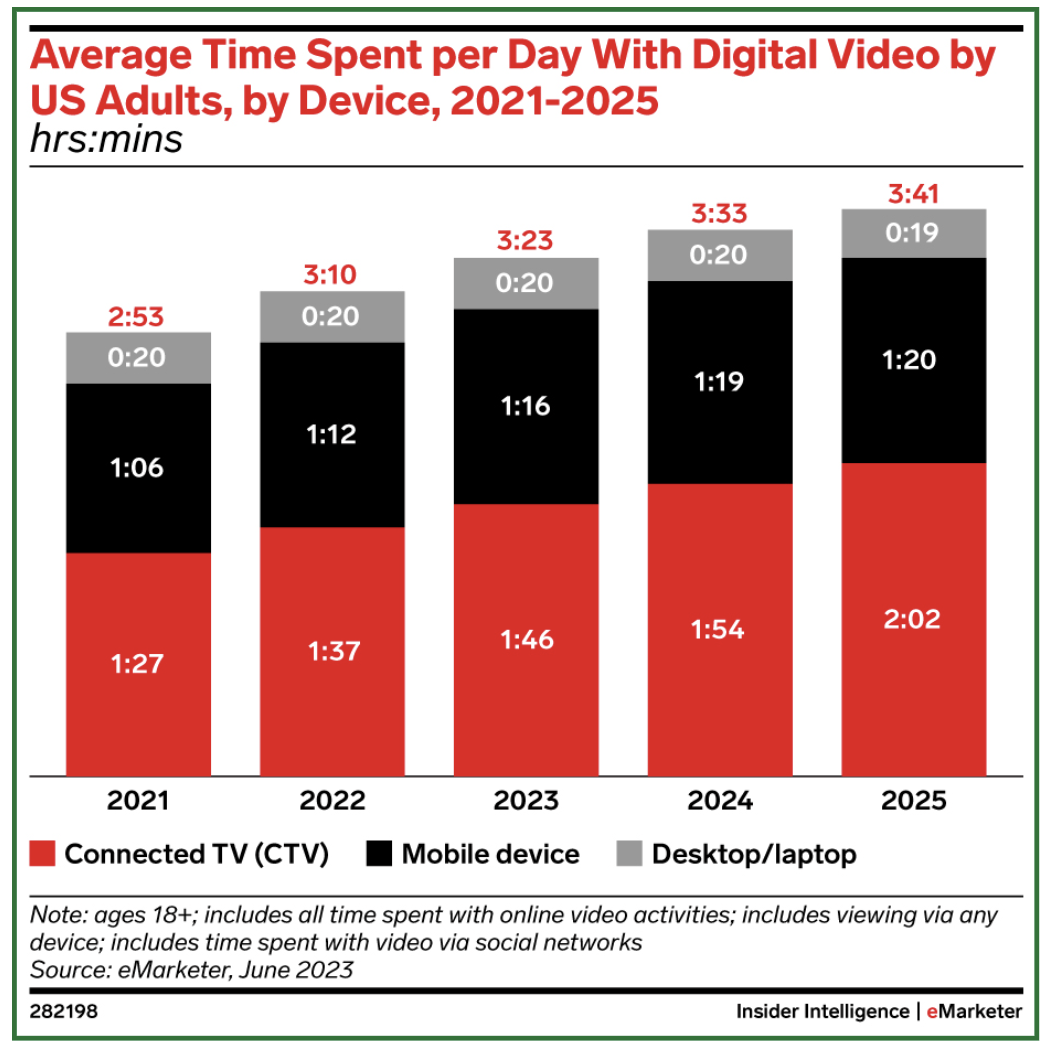

Connected TV (CTV) has not merely emerged; it has become the primary force reshaping how audiences interact with digital video content. As eMarketer’s 2023 forecasts reveal, over half of daily digital video consumption in the US now occurs on CTV, underscoring its role as the epicenter of the digital video experience. Users spend an average of 1 hour and 46 minutes per day on CTV, showcasing a clear preference for the immersive and communal experience provided by the big screen compared to mobile and desktop/laptop platforms.

The trajectory outlined by eMarketer indicates a further solidification of CTV’s position. Projections for 2024 anticipate a significant increase in daily time spent on CTV to 1 hour and 54 minutes, further distancing itself from mobile and desktop/laptop usage. This growth reinforces the strategic imperative for advertisers to tailor their campaigns to the CTV landscape as it continues to claim a larger share of digital video time, expected to reach nearly 55% by 2025.

At Simulmedia, we foster CTV transparency. In our pursuit of transparency, we introduced the Advertisers’ Bill of Rights for Transparency in Streaming TV,’ recognizing the challenges posed by opacity in CTV advertising. This initiative establishes transparency as a fundamental element for building trust, accountability, and efficiency in the medium. It outlines essential rights for advertisers, emphasizing where ads appear, how targeting and measurement function, and the need for accredited third-party measurement.

As we look forward to 2024, our focus will revolve around the escalating demand for transparency in the CTV space. We anticipate engaging with key challenges and predicting trends that will shape the landscape of CTV advertising.

Combatting Fraud in the Open Exchange

With most CTV ad impressions transacted through direct insertion orders and programmatic guaranteed, advertisers increasingly opt for trusted partnerships with reputable publishers. Recent results from The Trade Desk, as highlighted by Michael Morris, media analyst of Guggenheim Securities, indicate a sustained focus on quality inventory, particularly in CTV and retail media, despite softness in other areas, such as mobile and lower-end CTV demand. Recognizing the prevalence of fraud in the open exchange, advertisers begin to realize the importance of investing in reliable partnerships, understanding that the allure of exceptionally low prices in open exchanges may often signal fraudulent activities.

Additionally, as a softer form of fraud emerges, where suppliers provide blended rates that mix the CPMs of video delivered on connected TV with those of video on other devices, advertisers are becoming more astute in auditing their suppliers. They aim to isolate the cost of video delivered to genuine connected TV experiences on premium publishers, ensuring a clearer understanding of the value of CTV impressions and guarding against deceptive practices.

Advancements in Audience Transparency

Advertisers are seeking detailed insights into audience composition and methodologies. At Simulmedia, our approach goes beyond determining whether data is deterministic or inferred, delving into nuanced aspects such as the ratio of the final audience to the original seed. Privacy considerations, rigorous testing methods, and the integration of AI for holistic audience data analysis define our commitment to transparency.

Simulmedia recognizes the importance of asking the right questions to evaluate data sources comprehensively. From determining whether the data is deterministic or inferred to understanding the ratio of the final audience to the original seed, our approach emphasizes privacy considerations, testing methods, and the use of AI for holistic audience data analysis.

The Evolution of Measurement Standards

For the CTV industry, independent third-party measurement stands as the gold standard. However, events like the YouTube video ad debacle underscore the imperative for walled gardens to open their doors to third-party measurement providers. The need is clear — these providers offer an unbiased lens to evaluate and verify campaigns. Yet, the entry of more third-party verification providers into the activation game poses an inherent conflict of interest. To maintain neutrality and trust, walled gardens may pivot toward prioritizing third-party providers without inherent conflicts, ensuring impartiality in measurement practices.

Technological Innovations and the Rise of Walled Gardens:

Walled gardens, defined as closed ecosystems safeguarded from data exploitation, are set to play a pivotal role in shaping the CTV landscape. Major players like Roku, Netflix, YouTube, and Amazon have adopted this approach, protecting the integrity of CTV advertising by limiting access to exclusive inventory through proprietary technology.

Recognizing the significance of walled gardens in the CTV ecosystem, Simulmedia advocates for a supportive stance. Instead of resisting this trend, we believe in navigating this closed ecosystem with sophisticated technology that complements its unique dynamics. Collaborative approaches ensure advertisers can harness the power of walled gardens while maintaining transparency, trust, and efficiency.

A More Transparent Future for CTV Advertising?

As we journey into 2024, CTV transparency remains at the forefront of our mission at Simulmedia. By continuing to push for transparency, we empower advertisers to make informed decisions, build trust, and usher in a new era of accountability in the CTV advertising landscape. The big screen isn’t just a canvas; it’s a transparent window into the future of digital advertising, and Simulmedia is dedicated to guiding advertisers through this transformative journey.